Corporate Action

Corporate action (CA) are events initiated by a listed company that affects the rights attaching to the company's issued shares.

Some events are simple, mandatory and no action is required from shareholders (e.g. cash dividend) while others are more complex, optional and a response from shareholders is required (e.g. rights issue, privatisation).

Purpose of a corporate action can be:

- Distribute income (e.g. cash or stock dividend, bonus issue)

- Raise capital (e.g. rights issue, open offer)

- Restructure issued capital (e.g. share subdivision/consolidation, warrant exercise)

- Reorganise the company (e.g. spin-off, takeover and privatisation)

Effect on prices whenever there is a Corporate Action:

Typically, prices will be adjusted on all the types of corporate action on the ex-date. The prices fluctuation situations mostly happen on the CA announcement date or known latest news date, which is reflected in the market expectation changes. For example, a major shareholder may offer a premium price to purchase existing shareholding of privatization which will affect the market price to increase. Vice versa, the company announce rights issue at a discounted price for existing shareholders for subscription to raise monies which may affect market price to drop.

Company Announcements

For Company Announcements

Under the HKEX website > Market Data > Stock Quote Lookup > search by specific stock code or view the latest company announcement.

For Entitlement Corporate Action only

Under HKEX website > Market Data > Stock Quote Lookup > view up to past 5 years entitlement records under the lower portion.

Indicators for Corporate Actions on Trading System effective on 20 Dec 2015

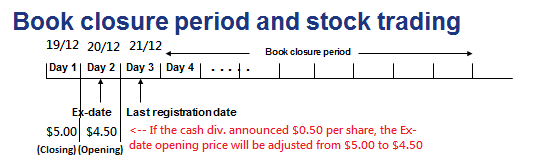

Under T+2 settlement system, stocks will trade ex-entitlement on the business day immediately before the last registration date. The date is so-called "ex-date".

The ex-date is the date on or after which the stock will be traded without the specific entitlement (e.g. dividend).

Ex-date is an important reference date to investors and all market players. Stock exchange, clearing house, stockbrokers, information vendors and custodian banks all have ex-dates maintained in their market systems. Any error of ex-dates will affect the orderly trading of the stock.

Corporation action on the GTD order

System will not inform clients on any corporate actions and will not make any adjustment on the GTD order if corporate actions occurred to the relevant stock.

Client should be closely monitoring any news or information relevant to their order.

SPAC

Stock Code

Stock codes of SPAC shares range from 7800 to 7999. Warrants of SPAC range from 4800 to 4999.

Order Qualifications and Methods

Only qualified Professional Investors can trade SPAC securities via UTRADE trading platforms (Web/ Mobile App) or by telephone.

Risks

Trading of SPAC shares involve high investment risk. We may unwind the ineligible position upon identification of such or in breach of any relevant rules. Investors should only make their investment decision after thorough and careful consideration.

Reference Materials

For more details about SPAC securities, please kindly refer to the below information from HKEX website.