HK Market & A-Shares - Order Type

At-Auction Limit Order

An at-auction limit order is an order with a specified price. An at-auction limit order with a specified price at or more competitive than the final IEP (in the event of buying, the specified price is equal to or higher than the final IEP, or in the event of selling, the specified price is equal to or lower than the final IEP) may be matched at the final IEP.

Any unfilled at-auction limit orders will be converted into limit orders and carried forward to the continuous trading session provided that the specified price of that at-auction limit order does not deviate 9 times or more from the nominal price.

Limit Order

A limit order having a price equal to the best opposite orders will match with opposite orders at the best price queue residing in the system, one by one according to time priority.

Enhanced Limit Order

An enhanced limit order will allow matching of up to 10 price queues (i.e. the best price queue and up to the 10th queue at 9 spreads away) at a time provided that the traded price is not lower than the input price. The sell order input price cannot be made at a price of 10 spreads (or more) below the current bid price whereas the buy order input price cannot be made at a price of 10 spreads (or more) above the current ask price. Any outstanding enhanced limit order will be treated as a limit order and put in the price queue of the input price.

Conditional Orders

- Send When Nominal Rises At / Above

- Send When Nominal Falls At / Below

- Hold Until It Release

- Stop Limit

- OCO (One Cancels the Other)

To learn more about conditional orders, please refer to the Hong Kong Conditional Orders section from UTRADE Web - HK/A-share Markets User Guide.

Odd lots of shares

HK Market

Odd lots of shares cannot be sold through UTRADE Online Trading Platform. Please contact our Client Services Hotline at (852) 2136 1818 if needed.

A-share

Odd lots of shares can be sold but cannot be bought through UTRADE Online Trading Platform. Please contact our Client Services Hotline at (852) 2136 1818 if needed.

Good-Till-Date (GTD) Order

Good-Till-Day (GTD) order allows your trade to remain valid within the expiry date which you have entered.

It supports HK and US markets and only with Price Limit orders. GTD orders will not support conditional orders. Send Now must be selected under conditional orders.

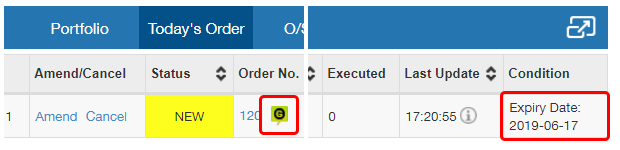

Upon placing a confirmed GTD order successfully

Under Today’s Order on UTRADE Web, you will be able to distinguish GTD orders as it will display a specific icon  next to your Order Number, and will show the expiry date under Condition.

next to your Order Number, and will show the expiry date under Condition.

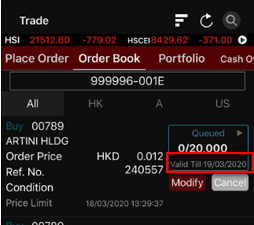

Under Order Book on UTRADE HK mobile app, the expiry date of the GTD orders will be shown in the order status's box.

Terms & Conditions

- GTD orders are sent to the market during market open everyday. The GTD order will be rejected if there are not enough funds or stock holdings in client's portfolio.

- All rejected GTD orders (including any rejected order caused by unforeseeable events or system disruptions) will be cancelled. Clients should pay attention to the order status/expiry date and place the orders again if needed.

- The order details of GTD orders (including but not limited to the quantity and price) will not be adjusted automatically by any corporate actions from the stock-issuing company, including but not limited to stock consolidation or split. The instructions of the GTD order will remain valid till the expiry date. Clients should closely monitor the status and any relevant information so as to amend the order details accordingly.

- The maximum validity for the GTD order is 14 calendar days, which will commence from the day after the GTD order is placed, based on HK Time.

- The unfulfilled quantity of a valid GTD order will be carried forward to the next trading day.

Notification

Client will not receive notification in any form, if the order is not fulfilled and is cancelled on the predefined expiry date. Client should be aware on the status of their orders.